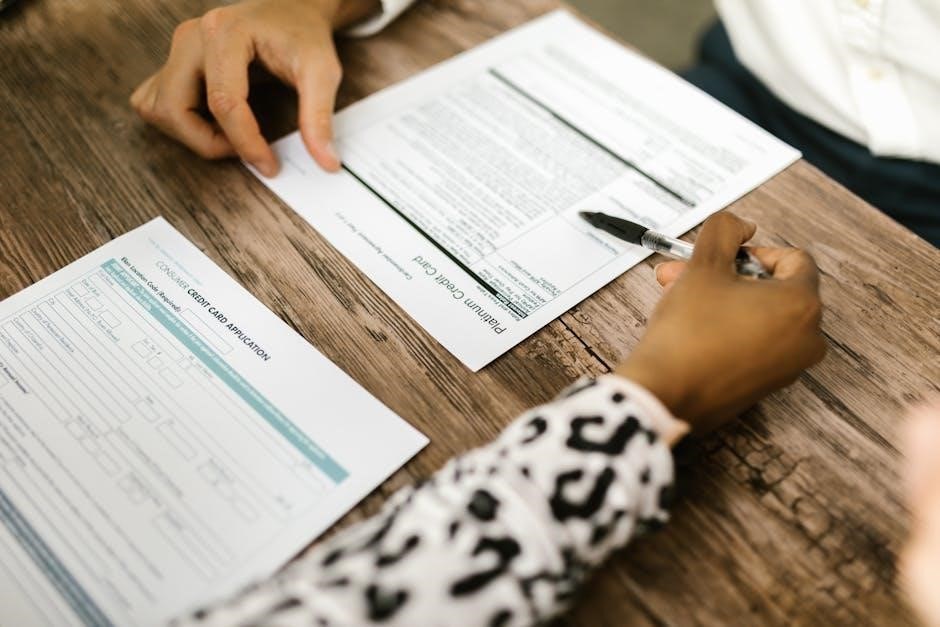

texas rental application form pdf

The Texas Rental Application Form is a document used by landlords to assess potential tenants. It helps evaluate credit, employment, and rental history to ensure a well-informed decision.

1.1 Definition and Purpose

The Texas Rental Application Form is a standardized document used by landlords to evaluate potential tenants. It collects personal, employment, and rental history information, along with credit check consent. The form helps landlords assess a tenant’s financial stability and reliability, ensuring informed decisions. It also includes a non-refundable fee for processing, typically covering screening costs. This document is essential for landlords to maintain property standards and comply with legal requirements, providing a clear framework for tenant selection and fair housing practices.

1.2 Importance for Landlords and Tenants

The Texas Rental Application Form is crucial for landlords to evaluate potential tenants’ credibility and financial stability. It helps landlords avoid costly issues by assessing creditworthiness, employment, and rental history. For tenants, the form ensures a fair and transparent screening process, protecting them from discriminatory practices. It also provides clarity on the criteria used for tenant selection, fostering trust and accountability between both parties. This document is essential for establishing a legally sound and mutually beneficial rental agreement.

Key Sections of the Texas Rental Application Form

The form includes personal and employment details, rental history, credit check consent, and standard sections from Texas Realtors, ensuring comprehensive tenant screening and legal compliance.

2.1 Personal and Employment Information

The Texas Rental Application Form requires applicants to provide detailed personal and employment information. This includes full name, contact details, Social Security number, and driver’s license information. Applicants must also disclose their current employment status, job title, employer’s name, and length of employment. Additionally, the form may ask for income details, previous employers, and military status. This section helps landlords assess the applicant’s financial stability and employment history, ensuring they can meet rental obligations. Accurate information is crucial for a smooth evaluation process.

2.2 Rental History and References

The Texas Rental Application Form includes a section for rental history and references. Applicants must list previous landlords, addresses of rental properties, and dates of tenancy. They may also be asked for reasons for moving and whether they provided proper notice. Landlords use this information to assess the applicant’s reliability and payment history. Additionally, applicants often need to provide references, which landlords may contact to verify the accuracy of the information. This section helps landlords evaluate the applicant’s past behavior as a tenant and their likelihood of fulfilling lease obligations responsibly.

2.3 Credit Check Consent

The Texas Rental Application Form requires applicants to consent to a credit check. This allows landlords to review the applicant’s financial history, including credit scores and reports. The consent is typically a written authorization within the application. Landlords use this information to assess the applicant’s financial stability and ability to pay rent. The credit check helps identify potential risks and ensure the applicant meets the landlord’s financial criteria for tenancy. This step is crucial for making informed decisions about approving or rejecting rental applications.

2.4 Standard Forms from Texas Realtors

The Texas Association of Realtors provides standardized rental application forms to help landlords streamline the tenant screening process. These forms, such as Form 2003, are officially recognized and include sections for personal and employment information, rental history, and consent for credit checks. Using these forms ensures compliance with Texas state laws and the Fair Housing Act, reducing legal risks. They are widely accepted and designed to protect both landlords and tenants by providing a clear and consistent framework for evaluating potential renters. This makes the application process efficient and legally sound for all parties involved.

Legal Requirements

The Texas Rental Application Form must comply with state laws and federal regulations, such as the Fair Housing Act, ensuring non-discrimination and proper handling of sensitive tenant information.

3.1 Compliance with Texas State Laws

The Texas Rental Application Form must adhere to state-specific regulations. Landlords are not restricted by caps on application fees or security deposits. Texas law allows landlords to charge any reasonable fee for processing applications, which typically covers credit and background checks. The form must also comply with the Texas Property Code, ensuring transparency and fairness in tenant screening. Failure to meet these legal standards may result in penalties or require refunds of application fees. Compliance ensures a balanced process for both landlords and tenants. Proper documentation is essential to avoid legal disputes.

3.2 Adherence to Federal Fair Housing Act

The Texas Rental Application Form must comply with the Federal Fair Housing Act, which prohibits discrimination based on race, color, religion, sex, national origin, disability, or familial status. Landlords are restricted from asking questions that could lead to discriminatory practices. The form must avoid inquiries about protected characteristics and ensure equal opportunity for all applicants. Violations of the Fair Housing Act can result in legal consequences, emphasizing the importance of fair and non-discriminatory tenant screening processes. Proper compliance ensures lawful and equitable treatment of all potential tenants.

3.3 Necessary Disclosures

Texas law requires landlords to provide specific disclosures alongside the rental application. This includes clear statements about tenant selection criteria, such as credit history, income, and rental background. The application must inform applicants that providing false information may lead to rejection. Additionally, landlords must disclose if a credit report will be used in the evaluation process. Failure to provide these disclosures can result in legal consequences, including the refund of application fees. Proper documentation ensures transparency and protects both parties from potential disputes. Compliance with these requirements is essential for a lawful rental process.

3.4 Required Signatures

The Texas Rental Application Form requires signatures from both the landlord and the applicant to validate the agreement. The applicant’s signature confirms they have reviewed and accepted the terms, including the tenant selection criteria. Landlords must also sign to acknowledge receipt of the application and consent to the screening process. Signatures ensure legal compliance and provide a formal record of mutual understanding. Proper execution of signatures helps prevent disputes and maintains the integrity of the rental application process in Texas.

Application Process

The Texas Rental Application Process involves submitting the completed form with a non-refundable fee, allowing landlords to review credit, employment, and rental history before approval or denial.

4.1 Submission Steps

To submit a Texas Rental Application, applicants typically complete the form online or in person. The process requires providing personal details, employment information, rental history, and consent for a credit check. A non-refundable fee, often between $20-$35, is usually charged to cover screening costs. Once submitted, landlords review the application, which may take a few days. Applicants are generally notified of approval or denial, with decisions based on creditworthiness, income stability, and rental history. Proper submission ensures landlords can thoroughly evaluate potential tenants.

4.2 Evaluation by Landlords

Landlords evaluate rental applications by reviewing credit reports, employment history, and rental references. They assess creditworthiness, income stability, and rental history to determine eligibility. Applications are often processed within a few days to a week, depending on the complexity of the screening. Landlords may use third-party services for background and credit checks. The evaluation ensures the landlord selects a tenant capable of meeting lease obligations, maintaining the property, and fostering a positive tenant-landlord relationship. Approval or denial is based on predefined criteria, with rejection letters provided if adverse action is taken.

4.3 Approval and Rejection Timelines

Texas landlords typically process rental applications within 1-3 business days, though complex screenings may take up to a week. Approval is granted once all verifications are satisfactory. If rejected, an adverse action notice must be provided, detailing reasons like poor credit or insufficient income. Landlords must send this notice within specific timelines, often required by law. Delays may occur if additional documentation or manual verifications are needed. Tenants should follow up if no decision is communicated within the expected timeframe. Failure to meet legal deadlines may result in liability for the landlord.

Fees and Costs

Texas rental applications often include non-refundable fees, typically $20-$35, covering credit and background checks. Security deposits vary, with no state cap, reflecting property-specific requirements and landlord policies.

5.1 Non-Refundable Application Fees

Texas landlords charge non-refundable application fees, typically ranging from $20 to $35. These fees cover the cost of credit checks, background screenings, and other verification processes. The state does not cap the amount, allowing landlords to set fees based on their expenses. Applicants are usually required to pay this fee upon submission, and it is non-refundable regardless of the application’s outcome. This practice is standard across Texas, ensuring landlords can efficiently evaluate potential tenants without financial loss.

5.2 Security Deposits as per Texas Law

Texas law does not impose a maximum limit on security deposits, allowing landlords to set amounts based on their discretion. Upon a tenant’s move-out, landlords must return the deposit or provide an itemized list of deductions within 30 days. Failure to comply may result in legal penalties. Landlords are also required to provide a written description of the property’s condition at the start of the tenancy to avoid disputes. This ensures transparency and protects both parties’ interests under Texas rental agreements.

Screening and Evaluation

Texas landlords evaluate tenants using credit checks, background evaluations, and employment verification to assess reliability and financial stability before approving a rental application.

6.1 Credit and Background Checks

A Texas rental application often includes credit and background checks to assess a tenant’s reliability. Landlords use these checks to review credit history, criminal records, and eviction history. The process typically requires the applicant’s consent and may involve third-party screening services. Credit checks help evaluate financial stability, while background checks ensure safety and reduce potential risks. These evaluations are critical for landlords to make informed decisions about approving or rejecting applications. Proper screening helps protect the property and ensures a positive tenant-landlord relationship.

6.2 Employment and Income Verification

Employment and income verification are crucial steps in evaluating a rental application. Landlords require proof of stable income to ensure tenants can afford rent. This may include pay stubs, W-2 forms, or employer letters. Self-employed applicants might need tax returns. Verifying employment helps landlords assess financial reliability and reduces the risk of non-payment. Accurate income verification ensures landlords make informed decisions, balancing tenant qualifications with property management needs. This step is essential for maintaining a positive cash flow and tenant-landlord relationship. Proper documentation is key to a smooth verification process.

6.3 Eviction History Checks

Eviction history checks are a standard part of the rental application process in Texas. Landlords review court records to identify past evictions, which may indicate potential risks. Texas law allows landlords to access eviction records, which are public. An eviction history can influence a landlord’s decision to approve or reject an application. Applicants with prior evictions may face stricter scrutiny or be denied tenancy. This step helps landlords protect their property and ensure a stable tenant-landlord relationship. Accurate eviction history checks are vital for making informed rental decisions.

Selection Criteria

Texas landlords use specific criteria to evaluate rental applications, including credit score, income stability, rental history, and employment verification. A non-refundable fee is often required for processing.

7.1 Legal Criteria for Tenant Selection

The legal criteria for tenant selection in Texas balance landlord rights with tenant protections. Landlords must evaluate applicants based on creditworthiness, rental history, income stability, and criminal background. They must avoid discrimination under the Fair Housing Act, ensuring equal opportunity regardless of race, religion, or other protected characteristics. A written notice of screening criteria is required, detailing factors like credit score, income requirements, and rental history standards. Failure to meet these criteria may result in application rejection, with landlords obligated to provide clear reasons if requested.

Texas law allows landlords to charge non-refundable application fees and set varying security deposit amounts. Compliance with both state and federal regulations is essential to avoid legal disputes and ensure a fair tenant selection process.

7.2 Avoiding Illegal Discrimination

Landlords in Texas must adhere to the Fair Housing Act, which prohibits discrimination based on race, color, religion, sex, national origin, disability, or familial status. Rental decisions must be based on objective criteria, such as creditworthiness, income, and rental history. Any bias or unequal treatment can result in legal consequences, including fines and lawsuits. It is essential to apply consistent screening standards to all applicants to ensure fair and lawful tenant selection.

Exemptions exist for certain cases, like owner-occupied buildings or senior housing, but landlords should consult legal experts to ensure compliance with anti-discrimination laws. Proper documentation and transparency are key to avoiding legal disputes.

Rejecting Applications

Rejecting applications in Texas must follow legal guidelines, including providing an adverse action notice if credit reports influence the decision. Landlords must communicate rejections clearly and promptly.

8.1 Adverse Action Notice Requirements

An adverse action notice is required in Texas if a landlord rejects a rental application based on credit or background checks. The notice must include the reason for rejection, the name and contact information of the credit bureau used, and a statement of the applicant’s right to dispute the accuracy of the report. This notice ensures transparency and complies with federal regulations. Landlords must provide it promptly, typically within a few days of the decision, to maintain legal compliance and avoid potential disputes. Clear communication is essential to protect both parties’ interests.

8.2 Legal Consequences of Improper Rejection

Improperly rejecting a rental application in Texas can lead to legal consequences. If a landlord fails to provide a required adverse action notice or discriminates illegally, they may face lawsuits or fines. Tenants can seek damages if rejected based on inaccurate or unfair criteria. Non-compliance with federal or state laws, such as the Fair Housing Act, can result in legal action and financial penalties. Landlords must ensure decisions are lawful and documented to avoid potential liability and reputational harm. Proper procedures help mitigate risks and maintain legal compliance.

Special Considerations

Special considerations ensure fairness and compliance when handling unique situations, such as multiple applicants or month-to-month leases, to maintain legal and ethical rental practices in Texas.

9.1 Handling Multiple Applicants

Handling multiple applicants requires landlords to ensure fairness and transparency. Each applicant should submit a separate form, and selection criteria must be applied consistently. Landlords should maintain detailed records of each application to avoid disputes. Additionally, clear communication with all applicants regarding the selection process and timelines is essential. This ensures compliance with fair housing laws and maintains positive relations with potential tenants. By following these steps, landlords can manage multiple applications efficiently and reduce legal risks.

9.2 Month-to-Month Leases and Subleases

Texas law allows for month-to-month leases, offering flexibility for both landlords and tenants. These agreements can be terminated with proper written notice, typically 30 days. Subleases are generally permitted unless prohibited in the original lease. Tenants must obtain landlord approval for subleases, ensuring compliance with the lease terms. Landlords should document all agreements to avoid disputes. Month-to-month arrangements and subleases require clear communication and written records to maintain legal compliance and protect all parties involved in the rental process.

Downloading and Using the Form

The Texas Rental Application Form can be downloaded for free from the Texas Realtors website in PDF and Word formats. Ensure correct completion by filling all sections accurately.

10.1 Sources for the Texas Rental Application Form

The Texas Rental Application Form is available from the Texas Association of Realtors website in PDF and Word formats. Landlords can download it for free, ensuring compliance with state laws. Additional templates are offered by legal aid websites, property management platforms, and real estate resources like iPropertyManagement. These sources provide updated versions, ensuring accuracy and adherence to legal standards. Using these official sources helps prevent legal issues and ensures the form meets all necessary requirements for tenant screening and property management in Texas.

10.2 Tips for Correct Completion

Ensure the Texas Rental Application Form is filled out accurately to avoid delays or rejections. Applicants should carefully review the form, providing complete and truthful information about employment, rental history, and personal details. Clearly indicate consent for credit and background checks, as required. Double-check all fields to avoid omissions or errors. Landlords should provide clear instructions and ensure the form complies with state laws and the Federal Fair Housing Act. Proper completion ensures a smooth screening process and legal compliance for both parties.

Texas-Specific Laws

Texas has minimal regulations on rental applications, with no caps on fees or deposits. Landlords can charge any reasonable amount for application fees and security deposits.

11.1 State Laws vs. Other States

Texas rental application laws differ significantly from other states, primarily in fee structures and disclosure requirements. Unlike many states, Texas does not impose limits on application fees or security deposits, allowing landlords to set these amounts at their discretion. Additionally, Texas law does not mandate centralized eviction databases, making eviction history checks more complex compared to states with unified systems. This flexibility in Texas law offers landlords broader discretion but also necessitates careful compliance with federal fair housing regulations to avoid legal complications.

11.2 Impact of Local Regulations

While Texas state laws provide a framework, local regulations can significantly impact rental applications. Cities like Austin and Dallas may impose stricter rules, such as rent control measures or specific tenant protections. These local ordinances can override state-level allowances, requiring landlords to adapt their practices; For example, some municipalities may mandate additional disclosures or limitations on fees. This patchwork of regulations means landlords must stay informed about both state and local laws to ensure compliance and avoid legal issues when processing rental applications.

Common Mistakes to Avoid

Landlords may overlook disclosing fees or screening criteria, leading to legal issues. Tenants might omit critical information, causing delays or rejections. Accuracy is essential for both parties.

12.1 Errors by Landlords

Common mistakes include failing to disclose non-refundable fees clearly, neglecting to provide required screening criteria notices, and improperly handling credit checks. Landlords may also overlook fair housing laws, leading to legal issues. Additionally, incomplete application reviews or inconsistent tenant selection processes can result in disputes or financial losses. Proper documentation and adherence to state and federal regulations are crucial to avoid these errors and ensure a smooth rental process for both parties.

12.2 Pitfalls for Tenants

Tenants may face issues like incomplete applications, missing deadlines, or providing inaccurate information, leading to rejection. Failing to review terms or understand fees can result in financial loss. Additionally, tenants might overlook their rights under the Fair Housing Act, leading to discrimination concerns. Ensuring all details are accurate and understanding the application process beforehand helps avoid these pitfalls and increases chances of approval. Tenants should also verify landlords’ compliance with state laws to protect their interests effectively.

12.3 Legal Pitfalls

Landlords must navigate legal challenges when processing rental applications. Non-compliance with the Fair Housing Act, improper use of application fees, and failure to provide required disclosures can lead to legal disputes. Additionally, not providing adverse action notices when rejecting applicants or conducting incomplete background checks can result in lawsuits. Ensuring all actions align with state and federal laws is crucial to avoid legal repercussions. Proper documentation and adherence to tenant rights are essential to maintain compliance and protect both parties involved in the rental process.

Resources and Support

Landlords and tenants can access legal aid, housing authorities, and official Texas Realtors resources for guidance. Websites like iPropertyManagement.com offer detailed forms and legal advice, ensuring compliance and understanding of rental processes.

13.1 Legal Aid and Housing Authorities

Legal aid organizations and housing authorities provide critical support for both landlords and tenants. The Texas Department of Housing and Community Affairs offers resources on rental rights and assistance programs. Legal aid services, such as those from Texas RioGrande Legal Aid, assist low-income tenants with housing disputes. Additionally, the Texas Association of Realtors provides guidance on fair housing practices and rental application processes. These resources ensure compliance with state and federal laws, helping to resolve disputes and promote fair housing practices across Texas.

13.2 Links for Further Information

For additional resources, visit iPropertyManagement.com for detailed guides on Texas rental laws and application processes. The Texas Association of Realtors website offers official forms and legal insights. The Texas Department of Housing and Community Affairs provides information on rental assistance and tenant rights. These links ensure access to up-to-date information, helping users navigate the complexities of rental applications and compliance with state-specific regulations effectively.

The Texas Rental Application Form is essential for landlords to evaluate tenants fairly and legally, ensuring informed decisions and compliance with state and federal housing laws.

14.1 Recap of the Form’s Role

The Texas Rental Application Form plays a crucial role in the tenant screening process. It provides landlords with essential information about potential tenants, including their personal details, employment history, rental background, and creditworthiness. This document helps landlords assess an applicant’s reliability and financial stability, ensuring they make informed decisions; Additionally, it ensures compliance with legal requirements, protecting both parties from potential disputes. The form is a cornerstone of fair and efficient tenant selection, promoting transparency and accountability throughout the rental process.

14.2 Final Thoughts on Importance

The Texas Rental Application Form is a vital tool for landlords to ensure responsible tenant selection. It streamlines the evaluation process, protecting both parties by verifying credit, employment, and rental history. This document not only aids in fair decision-making but also safeguards landlords from potential risks. Its role in maintaining legal compliance and fostering a professional rental process underscores its essential value. Ultimately, the form is indispensable for building trust and ensuring a smooth, transparent tenancy experience for all involved.

Leave a Reply

You must be logged in to post a comment.